This year’s property tax statements account for a total of $110.9 million which will pay for County Government Services (public safety, road improvements, elections, public health), City Services (police, fire protection, urban renewal projects), Education (K-12, Clatsop Community College, NW ESD), Port of Astoria and Rural Fire and other Special Districts.

This is an increase of $7.6 million (7%) compared to last year. The increase in taxes is due to several factors including the 3% increase in assessed value on most properties, value due to new construction activity and new or increased taxing district levies and bonds.

If you live in a taxing district that has new voter-approved bonds or local option levies, your property taxes may increase more than the anticipated 3%. New levies and bonds approved by the voters will be reflected in this year’s tax bills.

2023/24 Significant Tax Roll Increases

- City of Astoria – Library Bond | 2023/24 Bond Rate is .5545 cents per $1,000 assessed valuation

- Lewis & Clark RFPD – Local Option Levy | 2023/24 LO Rate is $1.15 per $1,000 assessed valuation- (Voters renewed the levy with .25 cent increase)

Discount

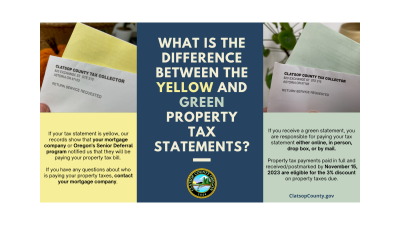

Property tax payments must be paid in full and received or postmarked by November 15, 2023 to be eligible for the 3% discount on property taxes due. Make Checks Payable to: Clatsop County Tax Collector

Online Payment Options

Credit and debit card payments can be made online by going to the Clatsop County Website’s Pay Tax Online link. Processing fees will apply. See webpage for details.

Online Property Information

Clatsop County has a searchable property account database which is now available to the public via Clatsop County’s website. This user-friendly feature gives the public direct access to up-to-date property tax and assessment information.

All you need to have to search and find what you are looking for is a street address, a property tax account number or TAXLOTKEY. (ex. 80908CB07100). Go to ClatsopCounty.gov and click on the “Property Info” link to learn more.

Installment Options

Please refer to the back of your tax statement for installment payment options and due dates.

- If you choose to waive your discount and pay your taxes in three installments, our office DOES NOT send out trimester reminder notices.

- For those paying in full, your canceled check is your receipt.

If you received a yellow statement, a mortgage company has requested your property tax information from us. Please contact your mortgage company if you have questions regarding your taxes being paid out of your escrow account.

E-Statement Paperless Option

Clatsop County offers property owners the ability to receive their 2024/25 property tax statements electronically. If you are interested in going paperless and wish to receive your future property tax statements via email, please go to our online property info page and sign up.

The deadline to sign up for 2024/25 tax statements is September 25, 2024.